Graduate students are eligible to apply for a Graduate PLUS loan if they need additional funding beyond their Federal Direct loans. Read more about PLUS loans here. >>

The federal government requires parent tax information on the FAFSA unless students meet specific criteria that establish independent status. The most common reasons students are considered independent are:

The FAFSA is the only application required for financial aid at UNC Charlotte. If additional information is needed, we contact students with specific requests. Do not send tax returns, W-2s, etc., to our office unless we ask for them.

To apply for scholarships, visit scholarships.uncc.edu.

The State of North Carolina automatically reviews all FAFSA information for state grant eligibility and notifies UNC Charlotte.

All financial aid awarded, including federal student loans and parent PLUS Loans, is based on information from the Free Application for Federal Student Aid (FAFSA). File the FAFSA online, www.fafsa.gov, using tax return and asset information.

International students are not eligible for financial aid.

However, we suggest you try these alternative options:

In order to apply for federal or state financial aid, students must complete the Free Application for Federal Student Aid (FAFSA) each year. It is available online at www.fafsa.gov.

Some financial aid is limited, so filing early means there is a better chance to receive some limited funding. Students who wish to have financial aid in place in time to pay bills in August should have the FAFSA completed and requested documentation submitted to our office no later than May 1.

Students who complete their FAFSA by Jan 1 will receive an award decision by March 1*. Submitting a FAFSA by March 1 will ensure an award decision by April 15*.

*Must have all outstanding requirements complete

Have you been admitted to UNC Charlotte? FAFSA information is brought into our system and aid packaged for students who have been admitted. We do not package aid for students who are not yet admitted.

Has it been longer than three weeks since you completed the FAFSA? If it has, go back to the FAFSA website, www.studentaid.gov to check the status of your FAFSA.

Contact Niner Central to follow up. We can check the Central Processor’s website, if necessary, to determine the status of the FAFSA.

I need to make a decision about attending school, but it depends on the financial aid I will receive. I have an EFC, but no financial aid information from UNC Charlotte. How can I decide?

Contact Niner Central and speak with a financial aid counselor. We can provide an estimate of anticipated financial aid, based on your EFC and your residency status.

You will receive an email when your financial aid award has been posted.

Log into My UNC Charlotte to check the status of your aid and determine whether there are outstanding requirements to be met.

Contact Niner Central if all requirements have been met and aid still has not disbursed.

Yes. The financial aid cost-of-attendance budget includes a room and board allowance.

UNC Charlotte financial aid does not allow students to purchase textbooks and charge their UNC Charlotte accounts. Students should be prepared to purchase textbooks with personal funds in case financial aid refunds are delayed. Eligible students can also utilize our Bookstore Advance Program to purchase textbooks, to learn more about program eligibility click here.

There are four ways to obtain a Tax Return Transcript from the IRS:

1. On line request at http://www.irs.gov/Individuals/Get-Transcript. Follow these steps:

a. On the main page under Tools, click "Order a Tax Return or Account Transcript"

b. Click "Tax Return Transcript" in Section 1

c. Click "Order a Transcript"

d. Enter tax filer's SSN, DOB, and Address (must match tax return exactly) & click "Continue"

e. In the "Type of Transcript" field, select "Return Transcript" and then the year

f. A paper Tax Return Transcript will be mailed to the specified address within 5-10 days.

2. Telephone Request: Automated 800-908-9946

3. Paper Request: IRS form 4506T - Must be used if you have moved since filing you taxes. The form can be downloaded at www.irs.gov.

4. Visit your local IRS office.

Cost of attendance information is updated yearly and is available here.

Your actual direct costs will vary depending on whether you attend full or part-time, which residence hall you live in, the meal plan you choose, etc.

For dependent students, parent PLUS Loans are available to help with educational expenses, up to the cost of attendance. Parents may apply for a parent PLUS loan. Learn more about PLUS loans here. Dependent students, whose parents are denied the PLUS Loan, may be eligible for additional federal unsubsidized student loan funds. Parents must apply for the PLUS Loan and be denied for the student to become eligible for additional student loan funds. Additionally, there are PLUS loans for graduate or professional students. Contact Niner Central for specific information. Non-federal loans may be an option as well. Please review our Alternative Loan Information page for a list of preferred non-federal lenders.

Contact Niner Central to discuss the situation.

EFC stands for “Expected Family Contribution.” After the FAFSA is processed using the federal methodology formula, an EFC number is calculated.This is the amount a family could be expected to have available to contribute toward the student’s education. This is not an amount of money you are expected to pay to the school. EFC ranks the FAFSA in order of “need.” (A student with a large EFC may not be eligible for need-based financial aid. Students with a low EFC may qualify for more need-based financial aid, including federal and state aid.)

Only students who are in a degree-seeking program are eligible for Federal or State financial aid. As a post-bacc student, you are not eligible for any Federal or State aid. However, post-bacc are eligible to apply for an Alternative Loan with a lender that does not require you to be a degree-seeking student.

Keep in mind you can also set up a UNC Charlotte payment plan.

Please note: Some post-bac graduate certificate programs ARE eligible for financial aid.

No. Unless students meet at least one of the FAFSA criteria that establish independent status, parent information must be included.

If you did not receive an email communication stating that we received your FAFSA information:

If you have an FSA ID, then you should use your FSA ID to sign your application electronically. When you sign your application electronically using your FSA ID, your application is processed within 3-5 days.

To sign your application electronically, click the Login button on the FAFSA on the Web home page to log in, and then click the Provide Signatures button.

If you do not already have an FSA ID, you can create a FSA ID.

Alternatively, you can choose one of the following options:

You may call 1-800-4-FED-AID (1-800‑433‑3243) to request a paper FAFSA.

With a reasonable idea of income, the FAFSA may be filed using estimated income information.

The UNC Charlotte school code for the FAFSA is 002975. You must list this code on your FAFSA in order to be eligible to receive financial aid from UNC Charlotte.

No. Investments do not include the value of the home in which you live, your car, the value of life insurance, retirement plans, pension funds, annuities, non-education IRAs, Keogh plans, etc., or cash, savings and checking already reported.

The FAFSA is used to determine eligibility for federal student loans. Federal loans have several advantages over non-federal loans.

Each lender has different borrower benefits and it is important to review them all carefully before choosing an option.

The money is posted to your account.

To find the loan provider/servicer for your Federal Direct Subsidized and Unsubsidized loans, you can login to your My Federal Student Aid account at studentaid.gov or contact the Federal Student Aid Center at 1.800.433.3243.

To sign the Master Promissory Note for a Stafford or Parent Plus Loan please go to the MPN page of StudentLoans.gov. You will sign the Master Promissory Note electronically using a Federal Pin number the same that was used on the FAFSA. Be very careful that you sign your Master Promissory Note so that it exactly matches your name on your Social Security Card. This will prevent any delays in the releasing of your funds.

After you have applied for an alternative loan:

Timeline

Watch your email

Updates to your financial aid award package

Loan disbursement

To update or make changes to your loan account, please complete the Loan Change Request form. Once received, we will be able to process your request.

Parent PLUS loans are loans that are applied for by the parent(s) of the student. Parents of a dependent undergraduate student may apply for a Federal Direct PLUS loan to help meet the student's cost of attendance not covered by other financial aid. Interest rates and repayment provisions on PLUS loans are generally more favorable than other alternative loans available for educational expenses. FAFSA is required, and parents must submit a PLUS loan request form to the Office of Student Financial Aid for certification of the student's cost of attendance as well as other anticipated financial aid.

Alternative loans are private education loans that help bridge the gap between the actual cost of your education and the amount the government allows you to borrow in its programs. Private loans are offered by private lenders and there are no federal forms to complete. Eligibility for private student loans often depends on your credit score.

The U.S. Department of Education requires that students complete an online loan entrance counseling session before loan funds can be disbursed.Loan entrance counseling provides students with information regarding their rights and responsibilities in regard to their federal student loans. It can be completed at StudentLoans.gov.

The interest rates currently range from 3% to 13% depending on the lender and your credit score.

Subsidized Loans are loans made to eligible undergraduate students who demonstrate financial need to help cover the costs of higher education.

Unsubsidized Loans are loans made to eligible undergraduate, graduate, and professional students, but in this case, the student does not have to demonstrate financial need to be eligible for the loan.

Read more about the difference between subsidized and unsubsidized loans.

At UNC Charlotte, the Office of Financial aid begins to process loans for the upcoming academic year after July 1st (when the university's new fiscal year begins). Unfortunately, until then we are unable to download Master Promissory Notes for new students. As long as you have completed it on the federal website (StudentLoans.gov) we will receive it when we begin processing new loans in July.

You may choose any lender of your choice. This handy ELM Select loan tool walks you through important information about types of funding and money management. It also presents your new responsibilities if you go on to borrow money.

After you review this information, you will see a list of lenders offering loan products in a way that makes it easy to compare them.

Federal student loan limits, for each academic year, are established by congress to help students manage loan debt.

Students with a large EFC number may not be eligible for need-based financial aid. Federal stafford loans are considered financial aid and are available to help students meet educational costs. Students may accept or decline any loan, or accept a portion of loans offered.

A Master Promissory Note is a promise to repay the loan you have been given to help with the cost of your education. An MPN is usually signed online, using the 4-digit FAFSA PIN number as the signature.

Exit Counseling is a federal requirement for all Federal Direct Loan recipients. Exit counseling was created to ensure that you understand your rights and responsibilities as a borrower. During the counseling, you will learn how to make payment of your loans easier and how to get help and protect your credit rating if you have problems.

Financial aid is credited toward your student bill after you have completed and submitted all required paperwork and documents. If you have been offered a student loan, be sure to complete the entrance counseling and master promissory note if necessary.

Your financial aid funds will initially be applied to charges on your student account. Any amount in excess of your student account balance will be sent via direct deposit or a check in the mail.

Most, but not all financial aid is applied to the student accounts at the beginning of the semester. Throughout the semester, if you are awarded financial aid, it will be applied accordingly. In both cases, financial aid refunds are mailed or direct deposits are applied within several days after the funds are applied to the student's account. If you have direct deposit the funds are applied to the appropriate banking account.

Any financial aid owed to you that exceeds your student account balance will be sent to the mailing address that you have on file with the University if direct deposit is not set up.

If your parents filed a foreign tax return, please submit a translated copy of the tax return. After review, you will be notified if any additional documentation is needed.

It depends on what information is on the document. We cannot accept any documents containing a Social Security Number (SSN) by email. This is for the protection of your information. Documents with SSN would need to be submitted in one of the following ways:

Fax: 704-687-1425

Mail: Office of Financial Aid, 9201 University City Blvd. Charlotte, NC 28223

On Campus: Niner Central - Cone 380

As long as your documents do not contain a full Social Security Number (i.e. last four digits of the SSN only would be okay), they can be emailed to finaid@uncc.edu. Marking out an SSN with a black pen often doesn’t make the number completely unreadable once scanned so please thoroughly review your documents before emailing to ensure that they do not have a visible SSN.

No. Verification must be completed before any financial aid monies can be awarded and disbursed to your student account. You are encouraged to submit any requested documents to us as soon as possible.

Yes! Niner Central can assist you with FAFSA and/or verification questions. No appointment is needed. We are open 8am-5pm Monday - Friday. You can contact us by phone at 704.687.8622, by email at ninercentral@uncc.edu or in person at Cone 380. For FAFSA questions, you can also contact the Federal Student Aid Information Center.

No. If you are selected for verification you must complete all requirements in order to receive financial aid.

During our busiest time of year, it may take up to six weeks for verification to be completed. Please respond to requests for information in a timely and complete manner.

Students who are unable to order via the website or phone can submit the IRS form 4506-T to the IRS.

Download IRS form 4506-T at https://www.irs.gov/forms-pubs/about-form-4506-t

Complete lines 1-4, following instructions on page 2 of the form

Line 3: enter the information of the person whose tax return transcript you are requesting (parent or student)

Line 6: enter the correct tax form number (i.e. 1040)

Check the box beside “Return Transcript”

Line 9: Year or period requested will be 12/31/20xx (for the 2019-2020 FAFSA we need the period ending on 12/31/2017)

The requestor must sign and date the form and enter their telephone number, then mail or fax the completed IRS form 4506-T to the address of fax number provided on page 2

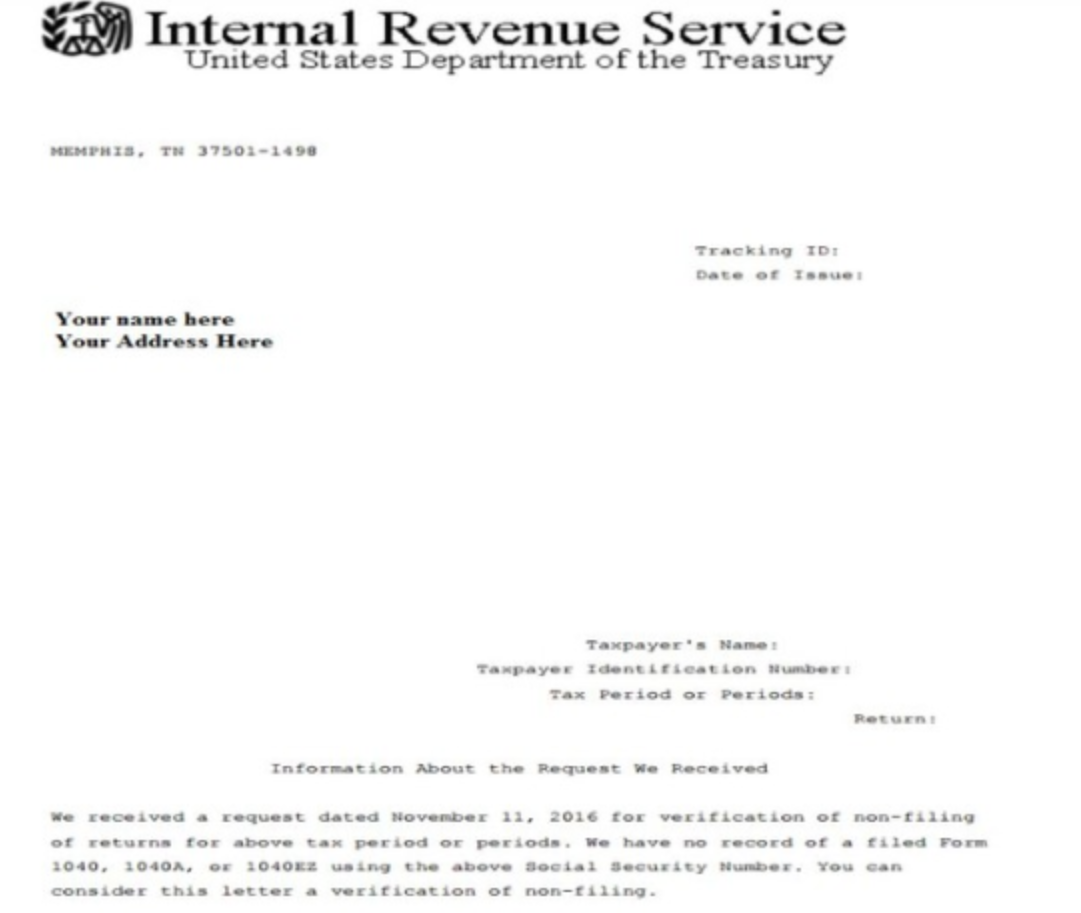

If the student/parent never filed (and were not required to file), please follow the same instructions but check the box on line 7 for “Verification of Nonfiling”

You can also make an appointment at a local Internal Revenue Office to obtain a copy.

For Federal Direct Subsidized and Unsubsidized loans, students will need to contact their loan servicer to get their loan out of default. To find your loan servicer, you can login to your My Federal Student Aid account at studentaid.gov or contact the Federal Student Aid Center at 1.800.433.3243. Before financial aid eligibility can be determined, student will need to get their loans out of default status and can request written confirmation from their loan servicer that their defaulted loans are out of default and in a current status.

For Perkins Loan defaults, we will need a letter from the school on their letterhead indicating that you are no longer in default on the loan.

Students can make changes to their FAFSA by logging in on fafsa.gov:

Log in as a returning user using your FSA ID and password

On the “My FAFSA” page, select “Make FAFSA Corrections”

Create a save key

Change the information

Submit new information

The new FAFSA transaction will be received and reviewed by the university within 2 to 3 business days. Please note: Depending on the changes made, you may be required to verify the changes. In these situations, you will be notified of what is required so please be sure to monitor your My UNC Charlotte account for any updates if making changes to your FAFSA.

The review of verification documents may take up to 10 business days to complete; however, processing times may change during peak season (start of term). After verification is completed, and if no additional requests are made, you would be awarded within 10 business days. Please continue to monitor your My UNC Charlotte account for any updates regarding the status of your verification and/or awarding status.

Students and/or parents will need to contact the IRS as information from the FAFSA or IRS may be indicating that they filed an Amended Tax Return. They can also request an IRS Account Transcript as this document will determine if an amendment was done. Please note that you will need to submit a copy of the IRS Tax Return Transcript along with either a signed and dated 1040X, IRS Account Transcript showing an amended tax return, or other document from the IRS regarding why your return may be showing as amended.

In order to complete verification, all required documentation must be submitted which includes any tax documentation. If you or your parents were required to file taxes, we would suggest speaking with a tax professional or referring to the IRS guidelines for more information on how to file. You will need to file and then provide us a copy of the IRS Tax Return Transcript once it is available through the IRS. If you choose not to file and are unable to submit the required documentation, the student will not be eligible to receive financial aid. The student could seek alternative loans but would need to submit a written statement identifying that they will not be seeking funds from the FAFSA and will not be completing verification.

In order to complete verification, all required documentation must be submitted. If you or your parents were required to file taxes OR if you/your parents filed incorrectly and need to amend your taxes, we would suggest speaking with a tax professional or referring to the IRS guidelines for more information.

If you were requested to submit a copy of your IRS Tax Return Transcript and you are amending your taxes, we will require both a copy of your IRS Tax Return Transcript and a copy of your signed, dated, 1040x (amended tax return).

We award students “Need Based Funding” which is determined by a student's EFC. We adhere to policies to award funds in a way that will try to meet the most student need, based on their EFC. All awards have specific eligibility requirements and so no student is guaranteed to receive the “full” amount of financial aid or enough funds to cover their total costs. If the university finds errors through the verification process and is required to make changes to your FAFSA, it is possible that your current awards could change if your EFC changes. You would be notified of your verification status and of any changes to your awards via My UNC Charlotte. You can find more info about EFC and awarding here: https://studentaid.ed.gov/sa/fafsa/next-steps/how-calculated

Depending on the changes made, you may be required to verify the changes. For example: If you made changes to income information, we will need to verify which income information is accurate. In these situations, you will be notified of what is required so please be sure to monitor your My UNC Charlotte account for any updates if making changes to your FAFSA.

If the student (or parent) was required to file based on the IRS guidelines, we would not be able to accept a Verification of Non-filing letter in place of an IRS Tax Return Transcript. The student (or parent) would need to file their taxes and then provide us a copy of the IRS Tax Return Transcript once it is available through the IRS.

Verification is a random process and approximately 30% of all FAFSA filers are federally selected for verification. If selected, we are required to complete verification in order to confirm that the data reported on your FAFSA is correct. Verification doesn’t mean that you did something wrong; it is just a normal part of the financial aid process. You are encouraged to submit any requested documents to us as soon as possible as you may not be awarded until after verification is complete.

No. If you are selected for verification you must submit all required documentation in order to receive financial aid.

We typically recommend online signatures as it makes the process faster.

In certain situations, a paper signature page for the FAFSA can be sent in on behalf of a student. The student will need to print the signature page, have the parent sign it and mail it to the appropriate address indicated here.

Verification forms can also be provided by Niner Central if a hard copy is needed instead of the online form.

The verification process is completed in order to confirm that the data you entered on your FAFSA is correct. If you are selected for verification, you will still need to submit the requested documents even if your situation has changed. However, if your situation has changed (or if you feel your current situation is not accurately reflected on your FAFSA), you may be eligible for a Reconsideration. Examples of circumstances which may warrant a Reconsideration are: job loss, death of parent or spouse, separation or divorce of parents, high unreimbursed medical and dental bills and receipt of one time payments. If you feel you may be eligible, please complete a reconsideration form. Please note: The Reconsideration Request form for the next academic year is available in early April each year.

To verify citizenship, we will need a signed U.S. Passport, U.S. Passport Card, Certificate of Citizenship, Permanent Resident Card (Copy of the front and back), Certificate of Naturalization, Visa, I-94 Arrival-Departure Record with date of entry stamp, or a Certificate of Birth Abroad (Issued to U.S. Citizens born abroad).

a. Males - Males between the ages of 18-25 are required to register for Selective Service and you must provide proof of your enrollment in Selective Service. If you need to register, you can do so online via sss.gov. If you are not required to register, you will need to provide proof as to why you were not required. For example: If you entered the country after the age of 26, you could provide a copy of your I-94 with the date of entry stamp. More information can be found here: https://www.sss.gov/Registration/Status-Information-Letter

b. Females - Females are not required to register for Selective Service but may be requested to do so if they left the gender question blank on the FAFSA. To clear this requirement, you may update the gender question on the FAFSA and you will also need to submit a copy of your birth certificate.

Are reports filed with the IRS (Internal Revenue Service or with the state or local tax collection agency containing information used to calculate income tax or other taxes, i.e. Form 1040.

Use Schedule C (Form 1040) to report income or loss from a business you operated or a Profit or Loss profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in From Business the activity with continuity and regularity. For example, a sporadic activity or a hobby does not qualify as a business. To report income from a non-business activity, see the instructions for Form 1040, line 21.

If the parent or student has not filed a Federal Tax Return, they can file for a tax extension (IRS form 4868), they must provide a copy of the extension and the verification specialist must notify the Counselor to award the student, but will not disburse any funds until the verification is complete. Once the signed federal tax returns and W2’s have been received and the verification is complete, the counselor will be notified to disburse funds and adjust the award if necessary.

Form W-2, a United States federal tax form issued by employers and stating how much an employee was paid in a year. Go to IRS.gov.

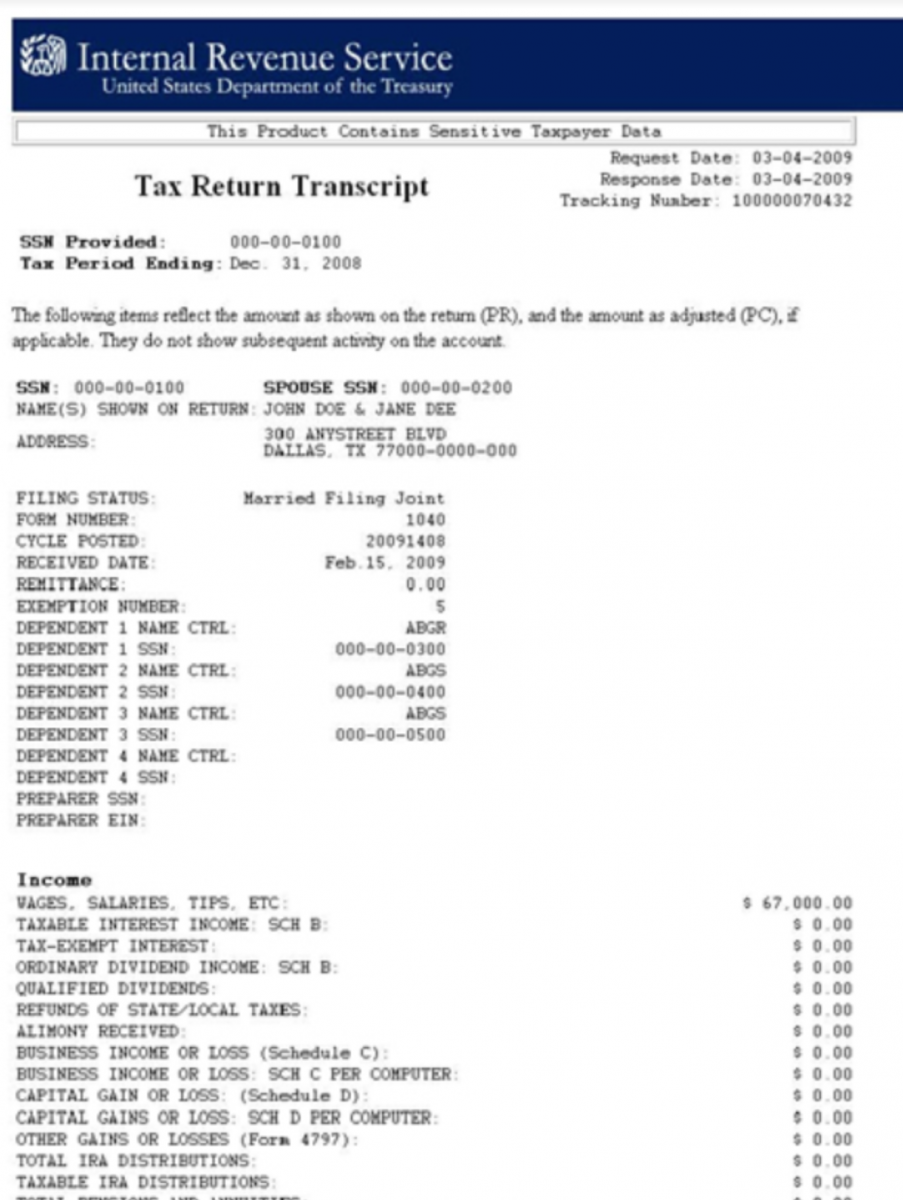

A tax return transcript shows most line items from your tax return (Form 1040, 1040A or 1040EZ) as it was originally filed, including any accompanying forms and schedules. It does not reflect any changes you, your representative or the IRS made after the return was filed. In many cases, a return transcript will meet the requirements of lending institutions such as those offering mortgages and for applying for student loans. You may Google your local IRS office to get a copy that day.

Processing Time for Verification normally takes up to two weeks; more time will be required during peak time.

This is a sample tax return transcript:

Verification is the process by which schools review student financial aid applications for accuracy. Institutions that participate in Federal Title IV aid programs are required to perform verification on a selection of students. Verification is done by collecting the documents the student used to complete the FAFSA and comparing them with the information the student provided on the FAFSA. You will not be able to receive financial aid until the verification process is complete. To receive maximum consideration for aid such as grants and/or work study, turn in all documents as quickly as possible.

If the student or parents file a tax extension you can tentatively be awarded, however no aid will disburse to the students account until the tax returns are filed and a copy is sent to the financial aid office.

Students will have access to all verification forms online via My UNC Charlotte by following these directions:

Login to my.uncc.edu

Click on Banner Self Service under “Quick Links”

Click on Financial Aid

Click Check Here To See If You Have Missing Requirements or Holds

Requirements with forms will have a link to the form. Student will enter the information as prompted.

The verification forms are also located online here: https://ninercentral.uncc.edu/financial-aid-loans/forms-and-publications

Please note: Be sure to complete the form for the appropriate award year.

There are some situations where someone will not be eligible to use the DRT. These situations include:

They are married and filed Married Filing Separately

They are married and filed Head of Household

They filed an amended tax return (1040X)

If you have been requested to submit an IRS Tax Return Transcript but you are unable to use the DRT, the student would need to submit documentation to verify the information entered on their FAFSA was correct. Documentation may differ depending on the above scenario that applies.

For situation 1, both parents (or the student + spouse) will need to submit a copy of their IRS Tax Return Transcript

For situation 2, it is possible that the filing status is inaccurate and the parents (or the student + spouse) may need to file an amended tax return OR they may need to provide documentation explaining why they were eligible to file as Head of Household even though they are married.

For situation 3, they would need to submit a copy of their IRS Tax Return Transcript and submit a signed and dated copy of their amended tax return (1040X).

Students and authorized parents can contact Niner Central with specific or additional questions.

This notation indicates that the student is a “Visitor” or they are in an ineligible program. The only way to fix this is to be accepted into an eligible program. Financial aid is only available to our degree-seeking undergraduate and graduate students.

If you are a visiting student here (i.e. taking classes at UNC Charlotte to transfer back to another institution at which you are degree-seeking), you would need to apply for financial aid with your home institution.

Post-bac students in undesignated programs are not eligible for traditional financial aid programs but may be eligible for alternative loans.

Please note: Some post-bac graduate certificate programs ARE eligible for financial aid.

A personal statement may not be sufficient for certain requirements. Sometimes a personal statement can be requested to explain a particular situation. Personal statements requested for verification purposes must be signed and dated. The signature must be a real (wet) signature - a typed signature is not valid

There are several reasons why this requirement may be marked as incomplete. We could have received the wrong form. The IRS Tax RETURN transcript can be accepted for this requirement. We could have received the right form but for the wrong year. The FAFSA uses “prior-prior” year tax information so for the 2021-2022 FAFSA we need 2019 tax information. If you submitted a 1040, it would need to be signed and dated. Please refer to your My UNC Charlotte, Banner Self Service, Financial Aid, Check Messages from Financial Aid Staff to see specific instructions related to the status of the request.

There is a possibility that financial aid may change as the result of verification. Freshmen are awarded before verification is complete and any student making changes to their FAFSA can be selected for verification. If the university finds errors through the verification process and is required to make changes to your FAFSA, it is possible that your awards could change. You would be notified of your verification status and of any changes to your awards via My UNC Charlotte.

Generally outside scholarship proceeds are forwarded to the UNC Charlotte Student Accounts office and posted to your account.

The Federal TEACH Grant has very specific qualification criteria. If you are interested in receiving the TEACH Grant, complete TEACH Grant counseling on the Federal Student Aid website. Upon receiving word from the program that counseling has been completed, the financial aid office will work to determine your eligibility and notify you if further steps are required.

Outside scholarships can sometimes affect other financial aid. However, generally the only impact outside scholarships have is a reduction in loan eligibility. Notify the financial aid office as soon as you become aware that you will be receiving an outside scholarship. If an outside scholarship causes a change in financial aid that has already been awarded, you will receive a revised financial aid award letter.

Yes. Pell Grants pay to students’ accounts based on their enrollment status. Students who are enrolled full-time will receive the entire amount of their Pell award. At UNC Charlotte, enrolling in 12 or more credit hours is considered full-time. Students who are enrolled for 9.00 hours are considered ¾ time and receive 75% of their Pell award. Half-time 50%, etc.

I am an out-of-state student. My home state offers scholarship funds to students attending in-state public institutions. Will UNC Charlotte match my home state’s funding?

No. Unfortunately, there is no reciprocity with out-of-state scholarship funds.

Online and library searches can provide a wealth of information about organizations that offer scholarship funds. You can access UNC Charlotte scholarships by visiting our Niner Scholars Portal. There is also a list of outside scholarship websites on UNC Charlotte’s scholarship webpage.

A scholarship from any organization or agency other than UNC Charlotte is considered an outside scholarship. Resources for these scholarships can include civic and/or community groups, church or religious organizations, employers, other states, etc.

UNC Charlotte offers over 1,000 scholarships each year to incoming and current students. Scholarships must be applied for and are awarded based on financial need, academic merit or both. Scholarships can be applied for beginning in October of each year through the NinerScholarsPortal. Application deadlines are typically in February or March, but some are significantly earlier. Please visit the University Scholarships website for more information.

In order to remain eligible for federal financial aid, continuing students must meet SAP standards. SAP is measured at the end of the spring semester to determine whether students remain eligible for financial aid. View the SAP policy.

Not always. If a federal student loan reduction is required based on the above calculation, the student's loan is reduced and the amount of the reduction is returned to the lender. That amount is charged to the student’s account. For example, if a student’s loan had to be reduced by $1,000 that amount would be returned to the lender, reducing the student’s overall loan debt. However, the student would owe the $1,000 to UNC Charlotte, immediately.

If you are out of school for at least 6 months, you need to begin repaying your loans. Your lender will contact you when repayment begins. If you return to school within 6 months, your loans will remain in deferment, but it is your responsibility to ensure the lender is aware you have re-enrolled. At UNC Charlotte the Registrar's Office sends enrollment information to the clearing house after the drop and add period for each semester.

In accordance to federal regulations, students must maintain satisfactory academic progress in order to continue receiving financial aid. Failure to earn certain minimum credit hours and/or grade point averages can casue a student to lose financial aid eligibility. For more information, please read the SAP Policy.

If all grades are not passing (W’s, I’s, or F’s), you will be required to have all professors sign the Confirmation of Attendance form indicating the last day of your participation or attendance. If the Office of Financial Aid does not receive the Confirmation of Attendance form by the deadline, ALL of your federal funding may be returned to the particular programs. If the professors confirm attendance but no specific date is given, we will prorate your financial aid based on the midpoint of the term. If you were paid a Pell grant on a full-time enrollment and your are not able to confirm attendance in all courses, your aid will be adjusted to the amount of the credits confirmed and the calculation will be based on the last date of attendance for the confirmed classes.

Students may only receive federal financial aid for one repetition (repeat) of a previously passed course. This means that students (undergraduate and graduate) who have already passed a course with a grade of D or better may only repeat the class one additional time and receive financial aid for that course.

No student may repeat a course a third time and receive financial aid for the course.

If you don't appeal or your SAP appeal is not approved:

Financial aid is awarded with the expectation that students will complete the semester for which aid was awarded. Students who are considering dropping classes, or withdrawing from UNC Charlotte, should contact Niner Central to discuss the matter. Some students may be required to return aid already disbursed to their accounts. Satisfactory Academic Progress (SAP) and federal student loan repayment may be a factor to consider as well.

Your SAP standing at UNC Charlotte is not transferred to the other school; however, your academic transcript cannot be released if you have any unpaid charges at UNC Charlotte.

All students whose SAP appeals are approved acknowledged an Academic Acknowledgment Plan as part of their SAP Appeal. The Academic Acknowledgement Plan sets the minimum requirements that need to be met by the student in order for them to maintain future eligibility for financial aid.

Satisfactory Academic Progress (SAP) Requirements:

Read more about Satisfactory Academic Progress (SAP) and appealing SAP >>

It may. Review the SAP Policy. Based on your SAP standing, you may not be eligible for future financial aid.

If you are not meeting SAP standards, and had to withdraw due to mitigating circumstances, you may appeal, using the Satisfactory Academic Progress Appeal form. Satisfactory Academic Progress Appeals are reviewed by a committee . The SAP Appeal process may take several weeks to complete.